What Should Happen After You File A Car Insurance Claim

There is nothing more disheartening than losing one’s home to a house fire. Seeing your dream home covered in soot, ashes, smoke, along with water damage throughout your home is saddening. The contents charred and windows blown out is more than a person can tolerate. Here are some suggestions that may help make the process of recovery a little easier on you and your loved ones.

In today’s world, poor customer service is nearly accepted as the norm. Sadly, we are overjoyed and amazed when we get good customer service. We’re astounded and tell all our friends when we get great customer service.

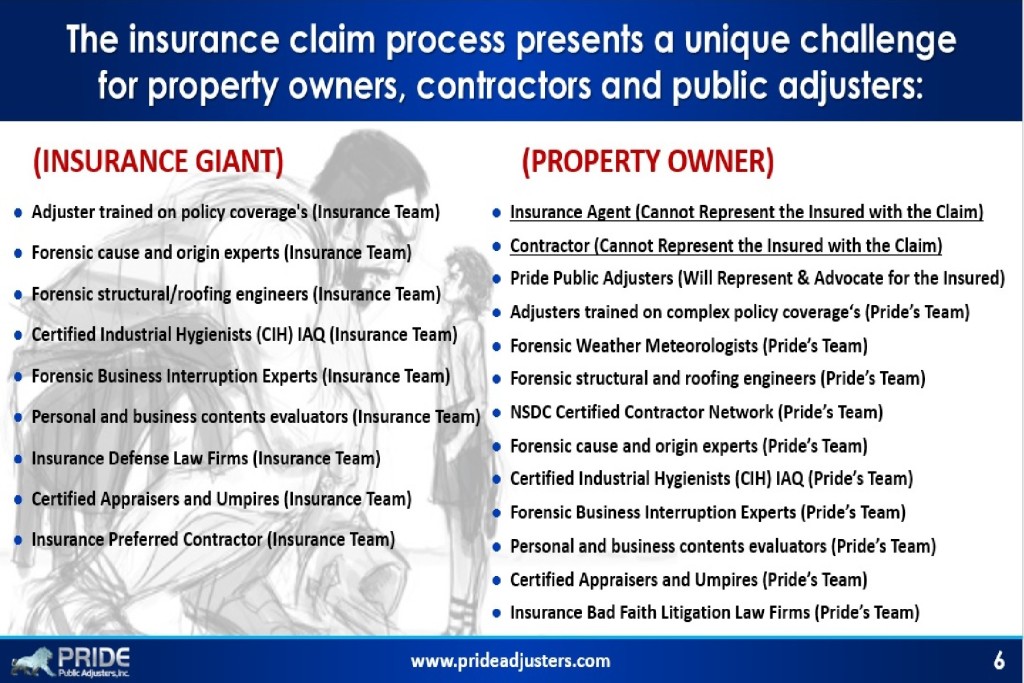

This is why it’s crucial for you to have the right Denver Colorado fire and water public Houston Flood claim on your side. They will be able to not only walk you through the process of claims and collecting your claim, but also can fight for you to make sure you get the best possible claim settlement or payout. The last thing you want to do is spend time trying to fight a case with yourself.

Be careful with what you say. Many adjusters will change your words to make it sound like you were apologizing for the accident because you were at fault. So a simple question like: is every one OK in your vehicle? will do the work.

Almost all homeowner insurance claims are physically inspected. This means that a claims public adjuster from your insurance company will be on your property. Adjusters inspect several claims every week and usually every day. Remember, your insurance claim is handled by human beings, the most important of which is your on-site claims adjuster.

Usually all of them are experienced. Only one of them is usually grey-haired with experience and broad-based skills. Most public adjusters have been company or independent adjusters before becoming exclusively public adjusters. Many have construction experience, either commercial or residential. But not even the title “Public Adjuster” is good enough. Get references and check them.

At this first meeting with the adjuster, make requests for advance payments, if necessary. (See Chapter Nineteen, Advance Payments.) If you’ve had a major Contents loss, like fire, smoke or water damage, you’ll need to replace some of these items quickly. If you have had a loss which leaves you unable to live in your home temporarily, you’ll need money to pay for hotel rooms, or temporary housing, or a short term lease for a house or apartment (Additional Living Expense coverage). Insurance companies will make these types of advance payments to the insured when the advance is requested. They seldom offer an advance.